How to Pay KRA Tax And Penalties Through Mpesa

Kenya Revenue Authority (KRA) has made the tax payment system much easier than it was before, with just your mobile phone you can be able to settle all your tax bills within minutes. In this article, we look at how you can pay KRA tax and penalties through M-Pesa as well as other payment modes.

In Kenya, once you attain the legal age with a stream of revenue, you are obligated to pay tax as required by the law without fail. As an employee, your tax contribution is deducted directly from your salary at the end of the month.

After that, you are obligated to file returns of your earnings at the end of every financial year. Failure to do that you earn a penalty from the organization, the penalties range from 10,000 to 10000 Ksh.

Back in the days, if you wanted to pay these penalties you had to visit KRA offices and do some paperwork before the payment process began. This process was a bit tiring and KRA decided to change how they operated and took the modern direction of automating their payment system as well as increasing the tax collection base.

In accomplishing this goal KRA has launched numerous platforms that can be used to pay taxes without visiting the offices. One of them is the M-pesa paybill number, USSD code. Below is how you can easily pay KRA via M-pesa.

How to Pay KRA Using M-Pesa

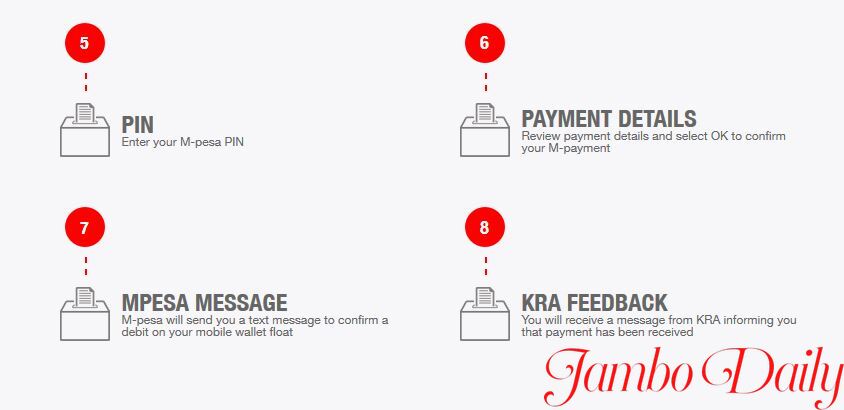

Using the Mpesa paybill number as the mode of payment is one of the easiest and most convenient modes of payment. However, unlike other bill payments, for KRA you have to first generate an E-Slip number or KRA payment reference number from KRA’s official website. Additionally, the E-Slip number generated will be determined with the services, for domestic taxes just log in to iTax and get the number but for custom services use the Simba Portal.

- On your mobile phone open the M-pesa app/ STK

- Navigate through the Lipa na M-Pesa option

- Select the pay bill option

- Under the “business number,” option enter the KRA paybill number “572572”

- Under the “account number” enter the E-slip number (E-Slip is generated online)

- Enter the exactly amounted indicated in the E-slip

- Enter your 4-digit m-pesa pin and proceed.

- Confirm the transaction and press “Send”

Pay Penalties Using M-Pesa

In case you find yourself on the wrong side of the tax agents and they penalize you, no need to panic since you can easily clear the penalties through mpesa. However, you must ensure you have a valid iTax PIN and then follow the process below.

- Log in to your itax account using your KRA PIN (Enter your password and solve the security stamp).

- Then generate your payment slip by using the below steps ;

- Head to the payments tools and choose the payment registration option and click next

- Fill in the required information.

- Under the mode of payment, select cash/cheque

- Go ahead and select the obligation period.

- The systems will automatically generate the expected payments including the interests.

- After clicking the “submit” button, KRA will send you a payment slip.

- The payment registration number will appear in the top right corner of the page, this is the number you’ll use as the account number.

- Once you have the account number

- Go to M-Pesa

- Lipa na Mpesa

- Under Pay bill, Enter KRA MPESA pay bill number 572572

- Under the account, field enter the number on the payment registration number.

- Enter the required amount not exceeding 70,000Ksh

- Confirm and details and proceed

- Wait for a confirmation from M-pesa.